Invoicing to Bertelsmann

One of Bertelsmann’s central goals is to continually further develop and improve collaboration with our suppliers. An important aspect of this is an optimized invoice processing procedure. This results in shorter processing times for your invoice and thus faster payment of the invoiced amount.

Please use e-invoicing via XML according to the EN16931 specification or send PDF invoices, in each case by email. By doing so, you choose a fast and cost-effective method of invoicing. A prerequisite for using our email channel is a one-time registration in this portal. After completing this one-time registration, you can send your invoices, reminders, and balance confirmation requests by email to all participating Bertelsmann companies.

For timely processing and payment, we kindly ask you to comply with the minimum invoice requirements listed. By agreeing during registration, you explicitly authorize us to return the invoice to you if information is incorrect or missing. In such cases, the invoice will not be processed.

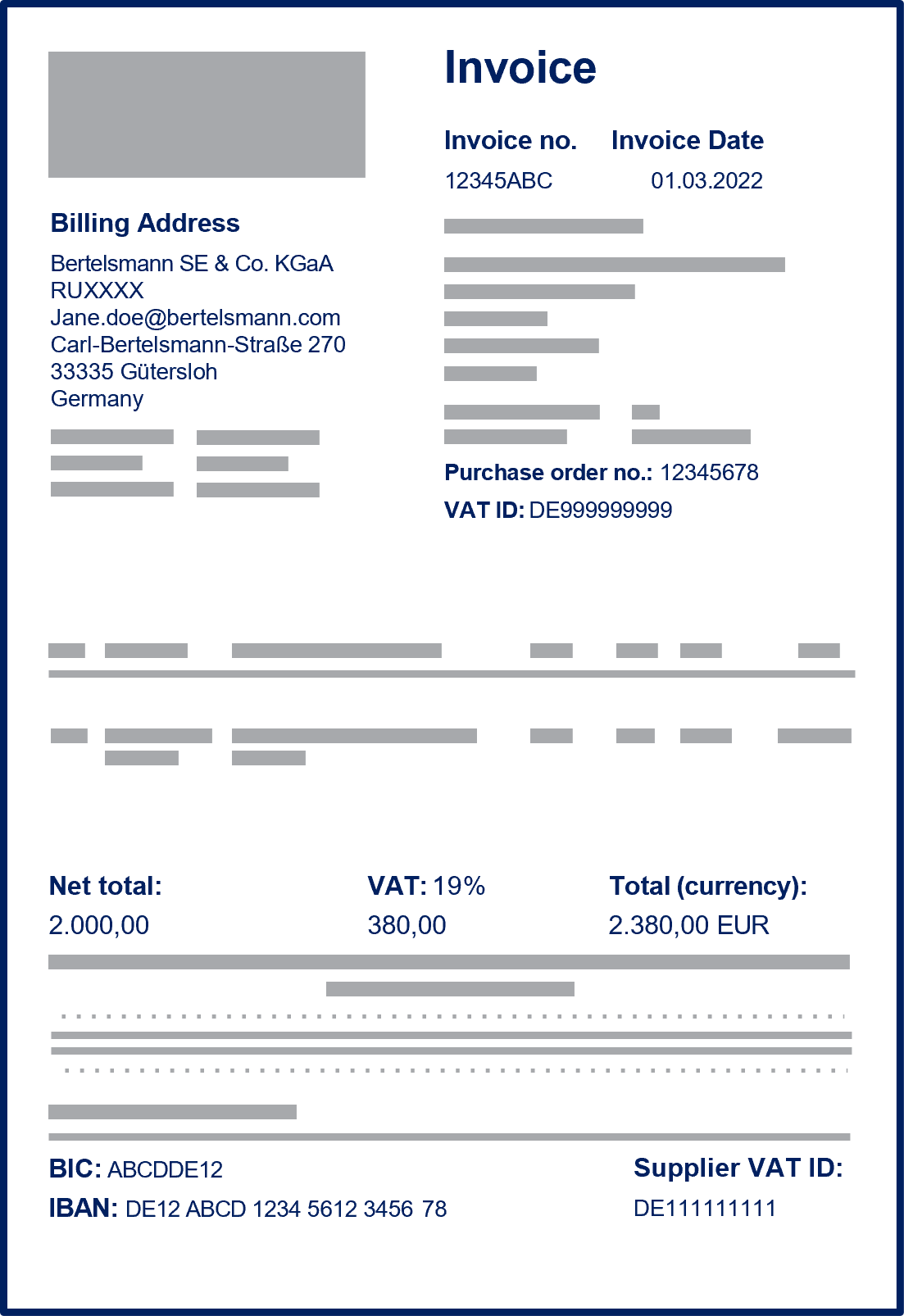

Requirements for invoice quality

Invoice quality is of extremely important for an optimised invoice process.

For this reason, we ask you to observe the minimum VAT requirements as well as our Bertelsmann-specific requirements.

- Compliance with local VAT requirements (e.g. for Germany §14 UStG requirements)

- VAT ID or tax number of you as well as of the respective Bertelsmann company

- Specification of your bank account details

- Specification of currency in ISO code (e.g. EUR)

- Invoice includes the gross, net and tax amount

- No handwritten information

- Invoice preferred on white background

- Invoice address only with the specified invoice address (see Downloads - "Participating companies")

- The four-digit RU (reporting unit) is mandatory as an address suffix in the invoice address

- For invoices with purchase order:

- Listing the correct purchase order number

- An invoice refers only to one purchase order

- For invoices without purchase order:

- E-Mail address of the purchaser (preferred) and/or

- Cost centre of the purchaser or project/order number

Invoice receipt channels

E-Invoicing via PEPPOL

In our e-invoicing process, we offer the possibility of electronic data exchange of invoice information between supplier and customer via the publicly accessible PEPPOL network (Peppol Directory – Introduction). A prerequisite for using the PEPPOL channel is registration and access through a PEPPOL service provider.

E-Invoicing via Email using XML

To use our email channel, registration on this portal is required. By registering, you confirm compliance with the Bertelsmann quality standards as well as the additional requirements listed for email transmission.

Minimum requirements for invoice submission via email in XML format and specification according to EN16931:

- One-time registration through this portal

- Use of the invoice email addresses of the respective Bertelsmann companies (see Downloads – Participating companies.pdf

- One email may contain only one invoice in XML format

- Attachments to the invoice must be included within the same XML

- Only invoices and credit notes may be sent to these invoice email addresses

- Transmission exclusively in XML format according to the EN16931 specification; no special characters in file names (e.g., " # % & * : > ? / | )

Technical requirements for XML via email:

- XML as a true attachment, not embedded in the email text

- Max. 20 MB per XML file

- No encryption of the email or the XML file

- No additional submission in paper format

Invoice / Reminder Submission via Email using PDF

To use our email channel, registration on this portal is required. By registering, you confirm compliance with the Bertelsmann quality standards as well as the additional requirements listed for email transmission.

Minimum requirements for PDF invoice submission via email:

- One-time registration through this portal

- Use of the invoice email addresses of the respective Bertelsmann companies (see Downloads – Participating companies.pdf

- One email may contain only one invoice in PDF format

- Please ensure that required tax documents (e.g., customs value invoice, border customs clearance) and any other relevant attachments are included within this PDF. Additional documents in other file formats (Office formats) may be attached in the same email.

- Only invoices, credit notes, and reminders may be sent to these invoice email addresses

- Transmission exclusively in PDF format; no special characters in file names (e.g., " # % & * : > ? / | )

Technical requirements for PDF via email:

- PDF as a true attachment, not embedded in the email text

- Max. 20 MB per PDF

- No encryption of the email or the PDF file

- No additional submission in paper format

Self-Billing Procedure

The automatic settlement of goods receipts based on an agreement between supplier and customer is known as the self-billing procedure. In this process, the supplier does not issue invoices.

Paper Invoices

Paper invoices may only be accepted in exceptional cases and after prior consultation via a designated recipient.

For any questions regarding registration, Bertelsmann quality standards, the various invoice submission channels, or inquiries to the accounting department (such as invoice status, requesting a payment advice, etc.), please use our contact form.

Thank you very much for your support!Your Bertelsmann Global Business Services

Reminders or Balance confirmations

For this purpose, please use the email addresses known to you for invoice delivery. (Downloads -> "Participating Companies.pdf"). Further information can be found in our Flyer Reminder.

Registration

Register now quickly and once for all Bertelsmann companies!

Contact

Contact us easily here.